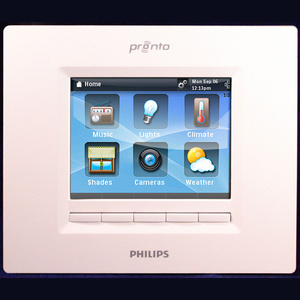

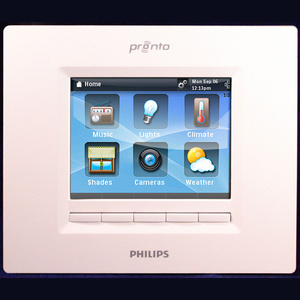

CIS is the Charlotte area's #1 retailer fo Universal Remote Control products! Call us today for a free evaluation

Integrators and other business partners say the iPod/iPad wasn’t to blame for the demise of Philips Pronto; why didn’t Philips try harder to find a buyer?

How hard did Philips try to sell its Pronto remote-control division?

Some of the major vendors in the CE pro channel never heard from the company, which announced last week it was closing its Pronto business unit.

When contacted by CE Pro, many of the obvious acquisition partners said Philips never approached them about buying the Pronto operation or its intellectual property. Why is that?

The closure of the Pronto division strands thousands of CE pros – including integrators and manufacturers – who invested in product training and software development, not to mention inventory.

While these customers need not be the concern of Philips, which must answer to shareholders, their commitment to the Pronto line suggests that a buyer could be found if Philips tried a little harder. Indeed, some potential buyers are scrambling now to inquire about the Pronto IP.

Replying by email to several questions posed by CE Pro, Philips had virtually nothing to say about the demise of Pronto, except that it was (understandably) too niche of a line for the Philips Consumer Lifestyle portfolio.

Is the IP still available for sale?

“There is no news right now on how Philips will use its IP and trademarks related to the Pronto business.”

Was the iPad/iPod to blame? Were Pronto price increases to blame?

“No, this was a strategic decision made by Philips. Philips derives its primary strategic strength from a broad and globally divided distribution network for its consumer products. We see very few opportunities for growth for Pronto in the future portfolio of Consumer Lifestyle products. Philips must make choices regarding which strategic markets it will invest in, and the niche market for Pronto products is not one of these.”

And so on.

So What Happened to Pronto?

Since Philips isn’t talking, we are left to our own speculation about why Philips closed Pronto and why a buyer wasn’t found.

The obvious question is: Did the iPod/ iPad kill Pronto?

Probably not, according to industry insiders interviewed by CE Pro.

More likely, Philips Pronto became too expensive, versus similar products from Remote Technologies Inc. (RTI), URC, Universal Electronics Inc. (UEI Nevo) and even Control4.

Philips is based in the Netherlands. Most of the Pronto business, including manufacturing, takes place in Belgium. Philips tried to shift Pronto manufacturing to Asia, but the company continued to build product more expensively in Europe. There is some speculation that agreements within the European Union hindered Philips’ ability to build Pronto products overseas.

Last year, Philips raised wholesale prices across the Pronto product line by as much as $200.

“I think Pronto couldn’t compete in the marketplace anymore,” says Richard Scholl, CEO of Worthington Distribution, a large Pronto distributor serving the custom integration market.

Scholl says Pronto business dropped substantially last year after the price increase, and not because of competition from the iPod or iPad.

Had Pronto kept prices down, in line with its competitors, it would have made a “major difference,” Scholl says.

According to Scholl, distributors have the opportunity to buy Pronto inventory until November 29, 2010, after which Philips will no longer accept orders.

Philips says it will continue to “fulfill its warranty obligations.”

It still leaves us wondering: Why didn’t Philips reach out to the usual suspects before shutting its doors?

By Julie Jacobson

Custom Installation Services, LLC – We specialize in fixing the $99 TV install by our “competitors”!

With the holidays and our busier than normal schedule over the past month, it has been a while since I have posted a blog. So, this will be different than my normal format of product news. I wanted to post a personal blog to thank all of our loyal clients for your support over the past year. 2010 was a good year for C.I.S., with new product offerings added to our lineup, as well as new and exciting technology trends. None of which would have been possible without everyone’s continued support!

With the holidays and our busier than normal schedule over the past month, it has been a while since I have posted a blog. So, this will be different than my normal format of product news. I wanted to post a personal blog to thank all of our loyal clients for your support over the past year. 2010 was a good year for C.I.S., with new product offerings added to our lineup, as well as new and exciting technology trends. None of which would have been possible without everyone’s continued support!